For the digerati, that’s news enough to trump the release of any new iPhone model (or for the true Google groupie, an Android device). But when your stock is valued in the stratosphere above $600 a share, even the smallest revamp can turn investors’ heads. But whether that’s a va-va-voom or rubbernecking at an accident depends on whom you ask. “Google listened to Wall Street by responding to its concerns before any other tech giant, reassuring stakeholders that their core businesses will remain stable,” says Peter LaMotte, senior vice president and chief of digital engagement at Levick, a public relations firm based in Washington, D.C. “This decision put Google ahead of the curve and their decision may influence other Silicon Valley giants to do the same.”

Then again, would Apple (AAPL)? Or Facebook (FB)? Or eBay (EBAY)? “I’m really surprised by the name change,” says Bennett Gross, investment strategist with EP Wealth Advisors in Torrance, California. “I think that the brand Google is exactly what people want their brand to be. It has become a verb to say, ‘I Googled that because I did not know what it meant.’ To ditch a name that has meaning, in my opinion, is a mistake.” So far, Wall Street has signaled a tentative thumbs up to Google 2.0. As of the close of trading Tuesday, shares of Google stock were up more than 4 percent – part of an amazing run that has seen Google stock climb 20 percent in the last month. Some market watchers see this as a chance for Google to address investor concerns. “Wall Street appeasement is certainly a major factor in Google’s decision to reorganize,” says David Gaspar, managing director of New York-based DDG, a consultancy that builds startups inside Fortune 500 companies.

It can help market mavens forget about the Google+ setback, while providing more transparency and efficiency. A former Microsoft Corp. (MSFT) executive wonders whether the change spotlights Google’s vulnerable underbelly. “This reorganization further exposes Google for what it really is, just an advertising company,” says Bob Herbold, once chief operating officer and executive vice president for the software giant. “The company makes the 89 percent of its revenue through ads, and all of their experimental efforts that get so much press coverage have shown no return to date – and quite frankly, are making the company’s investors nervous.” So what’s new so far as the ever-watchful investment community is concerned?

For starters, Alphabet Inc. will replace Google Inc. as the publicly traded entity, with all Google shares converting into the same number of Alphabet shares. Google now becomes a wholly owned subsidiary of Alphabet, and still lends its name to Alphabet’s Nasdaq ticker symbols, GOOGL and GOOG. The new company has a cheeky URL – abc.xyz – and in Monday’s investor letter, “G is for Google,” Page described Alphabet as “mostly a collection of companies.” The new Google “is a bit slimmed down,” with various pieces such as Calico (a company researching the aging process) now under the Alphabet umbrella. Alphabet will operate with Page as CEO and Brin as president; Google’s highly-respected products chief, Sundar Pichai, becomes CEO of Google.

Thoughtful investors might want to look under the hood at what Alphabet will contain. “You see it with Amazon [AMZN], for instance, which has grown a bunch of sub-brands such as Zappos,” says Rita McGrath, professor of management at Columbia Business School in New York. “By supplanting the strong Google brand with Alphabet, Page and Brin are signaling that the sky is the limit for their powerhouse of brands,” says Rebecca Brooks, a founding member of Alter Agents Market Research in Los Angeles. “New ventures won’t have to be constrained by the Google heritage. They are free to be whatever they want to be.” All that said, what’s in a name: and is this a stale stunt or a fresh start? “It’s a brilliant name which has a hidden meaning,” says Duncan Davidson, managing director at Bullpen Capital, an early-stage, post-seed venture fund in Menlo Park, California. “The alphabet soup of separated companies are ‘alpha bets,’ investments in a potential large ‘alpha,’ or fundamental value.” McGrath is more skeptical. “I’m not sure I’m overwhelmed with Alphabet,” she says. “But finding good names for things these days is very tricky.

The name has to travel globally, not belong to anyone else and not mean anything in particular to be a good umbrella brand name.” (Alphabet is also the name of a BMW subsidiary; the German auto manufacturer says it is trying to determine if Google would be infringing on its trademark.) Alphabet translates to “Alfabeto” in Italian, “Arufabetto” in Japanese and “Abeceda” in Czech – whereas Google is universally and triumphantly Google, even in Esperanto. Yet for all the analysis and dissection, Page hopes to give investors the final word by putting a folksy spin on the Alphabet game. “Don’t worry,” he writes. “We’re still getting used to the name too!”

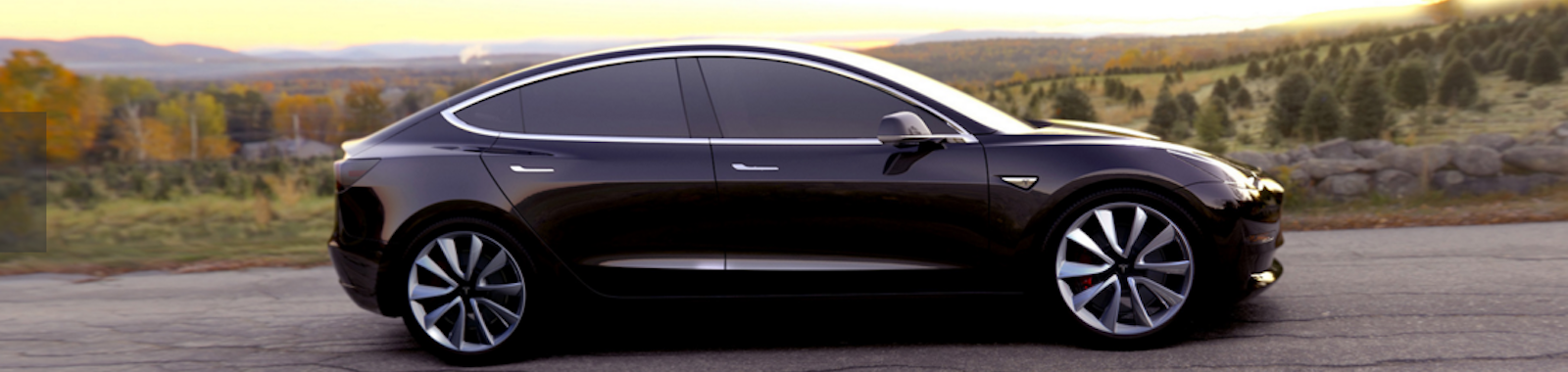

“A combination of factors leads to Tesla’s marketing success: Innovative, revolutionary products and a genius CEO Elon Musk who has track record of success. I’m not sure you can replicate what Tesla has been doing – or if there’s a marketing model for other brands,” said Rebecca Brooks, co-founder of market research firm Alter Agents.

“A combination of factors leads to Tesla’s marketing success: Innovative, revolutionary products and a genius CEO Elon Musk who has track record of success. I’m not sure you can replicate what Tesla has been doing – or if there’s a marketing model for other brands,” said Rebecca Brooks, co-founder of market research firm Alter Agents.

Like a bad boyfriend, brands lie and cheat. There’s no shortage of examples, including Volkswagen most recently, but also Amazon, Apple and Google, among others. And, like an insecure girlfriend, if consumers love a given brand enough, they are more than willing to forgive – after perhaps a period of cooled intimacy.

Like a bad boyfriend, brands lie and cheat. There’s no shortage of examples, including Volkswagen most recently, but also Amazon, Apple and Google, among others. And, like an insecure girlfriend, if consumers love a given brand enough, they are more than willing to forgive – after perhaps a period of cooled intimacy.